Electric vehicles rely on a fundamentally different drivetrain than traditional gasoline cars. The heart of an EV is its EV powertrain, which consists primarily of the electric motor, inverter, and battery pack. Understanding the roles and interactions of these components—electric motor basics and battery fundamentals—is key to appreciating how EVs achieve instant torque, high efficiency, and zero tailpipe emissions.

1. The EV Powertrain Overview

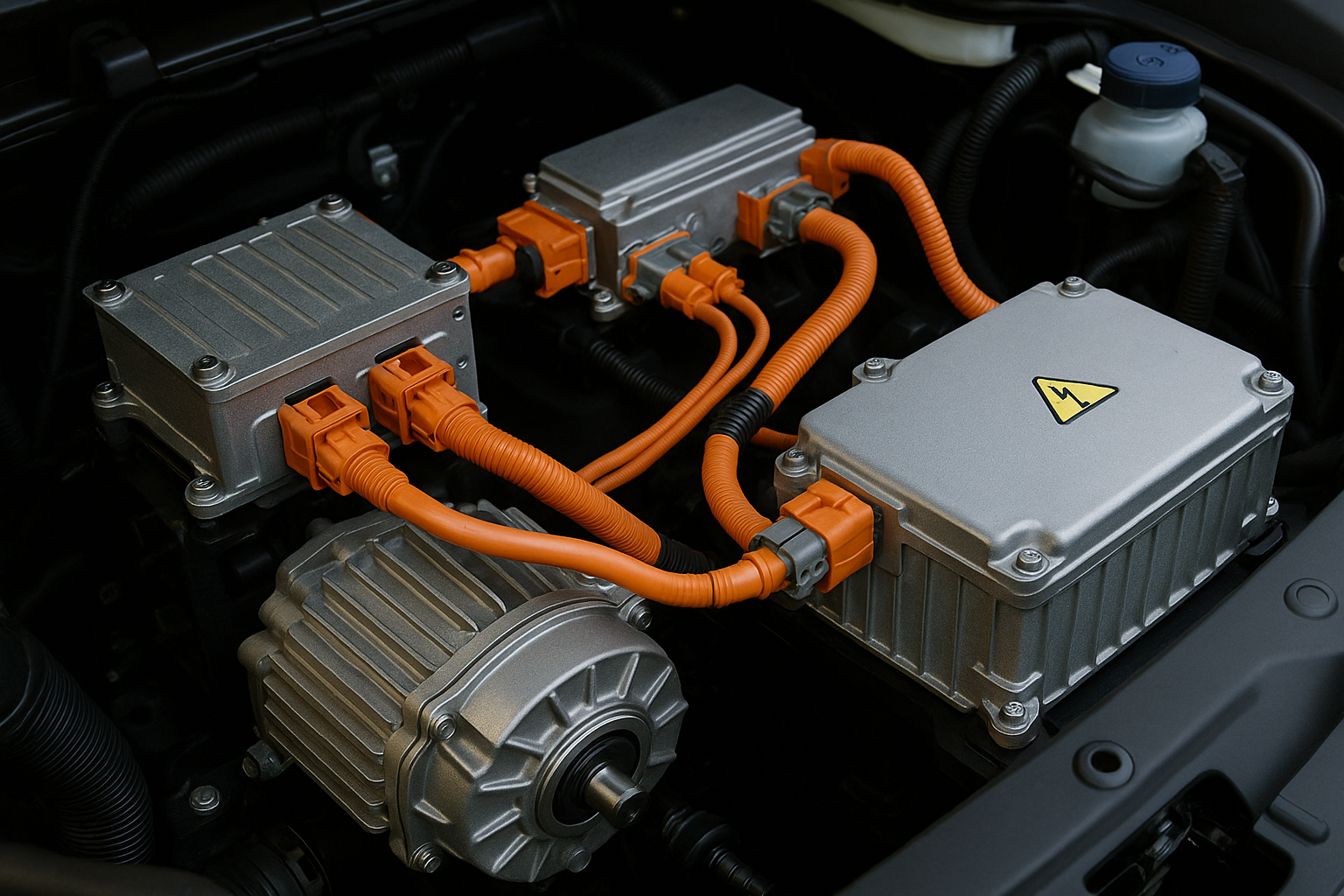

An EV powertrain replaces the internal combustion engine, transmission, and fuel system with three main elements:

- Electric Motor: Converts electrical energy into mechanical rotation to drive the wheels.

- Inverter: Manages power flow by converting DC battery voltage into AC for the motor, and vice versa during regenerative braking.

- Battery Pack: Stores electrical energy in a series of cells and delivers it on demand to the inverter and motor.

Unlike multi‑gear transmissions in ICE vehicles, many EVs use a single reduction gear, relying on the motor’s wide torque band for acceleration and cruising.

2. Electric Motor Basics

The electric motor is the centerpiece of EV propulsion. There are several common types:

- Permanent Magnet Synchronous Motor (PMSM): Uses rare-earth magnets on the rotor to create a constant magnetic field, offering high efficiency and power density.

- Induction Motor: Relies on electromagnetic induction to generate rotor currents; robust and inexpensive but slightly less efficient at low loads.

- Switched Reluctance Motor (SRM): Utilizes variable reluctance in the magnetic circuit; emerging for its simplicity and high-temperature tolerance.

In operation, the inverter supplies three-phase AC currents to the stator windings. These currents create a rotating magnetic field, which interacts with the rotor’s field (permanent magnets or induced currents) to produce torque. The motor’s instantaneous torque—available from zero RPM—delivers the brisk acceleration EVs are known for.

3. Inverter Function and Control

The inverter serves as the brain of the EV powertrain. Key roles include:

- DC-to-AC Conversion: Transforms the battery’s DC voltage into variable-frequency AC to control motor speed and torque.

- Regenerative Braking: Captures kinetic energy during deceleration by reversing the motor’s operation, converting mechanical energy back into electrical energy and storing it in the battery.

- Thermal Management: Monitors and manages its own temperature to avoid overheating under high loads.

Modern inverters use high‑speed semiconductor switches (IGBTs or SiC MOSFETs) and sophisticated pulse‑width modulation (PWM) algorithms to deliver smooth torque control, high efficiency, and precise response.

4. Battery Fundamentals

The battery pack is the EV’s fuel tank. Understanding battery fundamentals involves:

- Cell Chemistry: Most EVs use lithium‑ion cells—variations include NMC (nickel manganese cobalt), LFP (lithium iron phosphate), and NCA (nickel cobalt aluminum)—each balancing energy density, cost, and longevity.

- Module & Pack Design: Cells are grouped into modules, which are assembled into a pack. The pack includes structural support, cooling plates, and wiring harnesses.

- Battery Management System (BMS): Monitors cell voltages, temperatures, and currents, ensuring balanced charging/discharging and protecting against over‑charge or over‑discharge.

- Thermal Control: Liquid or air cooling maintains optimal cell temperature (often 20–40 °C) to preserve performance and lifespan.

Pack capacity, measured in kilowatt‑hours (kWh), directly influences driving range. Efficient thermal and BMS strategies help maximize usable capacity and extend battery life.

5. Integration & Efficiency Considerations

To maximize overall efficiency, EV designers integrate motor, inverter, and battery into a cohesive system:

- Power Electronics Co‑Location: Placing the inverter close to the motor reduces high‑voltage wiring losses.

- Regenerative Braking Tuning: Balances energy recapture with drivability, modulating how aggressively the motor switches to generator mode.

- Thermal Synergy: Shared cooling loops for motor, inverter, and battery minimize system complexity and improve thermal stability.

Careful system integration allows leading EVs to achieve well over 90 percent drivetrain efficiency—far surpassing most internal combustion vehicles.

Conclusion

Mastering the electric motor basics, inverter control, and battery fundamentals provides a solid foundation for understanding any EV. The EV powertrain blends these technologies to deliver quiet, efficient, and high‑torque propulsion. As innovations in motor design, power electronics, and battery chemistry continue, future EVs will only become more capable, affordable, and sustainable.